Purchasing A Vacation Home

5 things to consider when purchasing a vacation home

Buying your first home is an amazing time in your life. This first major investment is yours to change precisely to your liking. The color schemes of the walls, the flooring, the floor plan, the landscaping — it’s all yours.

When you’ve come to a point in your life where you want to purchase a vacation home, you’ve experienced some of the hardships of homeownership, but not all of them. Vacation home ownership, especially in different states than where you own your primary home, has a different checklist you need to consider.

1. How do you plan to use it – now and in the future?

A vacation home is somewhere you can picture yourself enjoying quality time with family and friends instead of adhering to strict check in and check out times. After all, you have no housekeeping schedules with time constraints on you. Second homes allow the freedom to decorate the way you want and there are no timeshare rules you need to follow. How about five years from now, or 10? Will it still have that vacation home feel or will you be looking to explore a new area? Is this a vacation home just until the kids or grandkids get older? Or, do you need income from your investment?

Depending on those answers, you may have to get a business plan together. That’s when factors such as a management company, and their cost, come into play. Or, these days, you can take the route of renting through various DIY websites. You’re then renting, cleaning and servicing appliances remotely for this vacation-hometurned-investment-property.

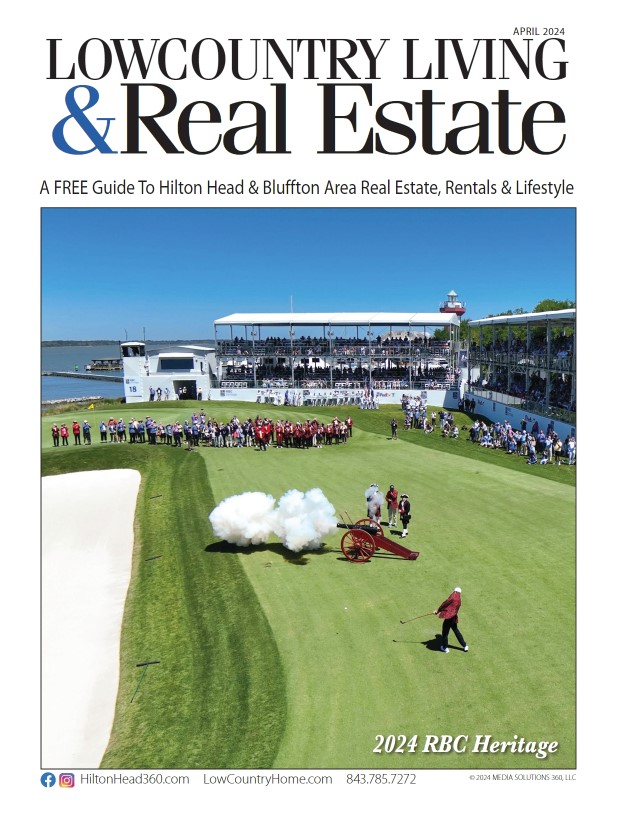

Considering a move to the Hilton Head area? Our Members access the latest Real Estate data, inventory, and tracking trends to help you find your perfect piece of the Lowcountry. By utilizing the most advanced tools in the industry, we make the process smooth and simple for buyers and sellers. Turn to an HHIMLS member to make South Carolina your home today.

2. Stay in your budget, including added costs

Whether you plan to keep your new vacation home to yourself or rent it out, it’s important to remember to stay within what you can afford. Are you ready for insurance rates and taxes to gradually increase over the years on both your primary home and your vacation home? Is the property in a planned community with assessments?

It may sound like a no-brainer, but this is a (presumably) second major investment you will be making so budgets can be stretched thin if the theoretic perfect storm hits. If a major remodeling job like replacing a roof is needed at your primary home and your vacation home needs the same in the same year, will your budget be able to afford it? Do you know the local and state laws about rental properties and do those laws affect your bottom line?

3. Consider all times of year

Sure we picture owning a vacation home during the best time of year for us — whether it’s for weeklong getaways in the summertime or for quick trips to escape the blustery cold of the North. But how about the downtimes when you’re not there? Who will be there to batten the hatches if a major storm comes through the area? Will the property need special care to adapt to the seasons, like winterizing?

If your vacation home needs annual attention at different times of the year, take into account who will tend to those items.

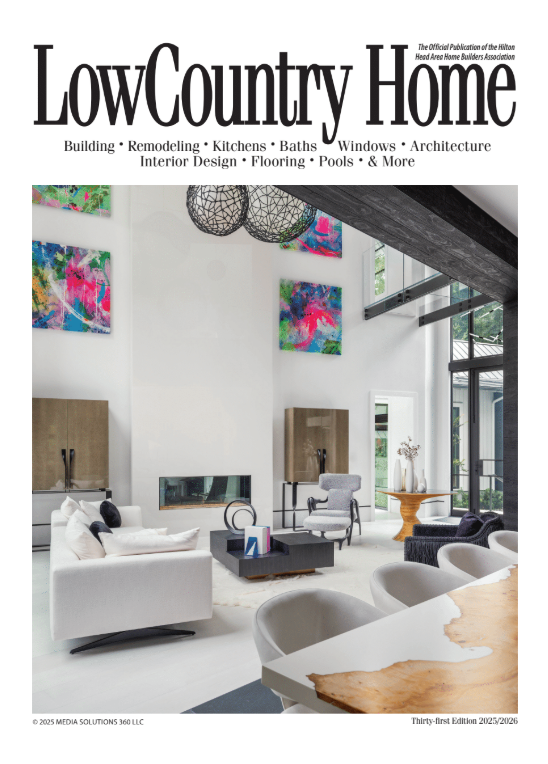

Discover the Difference

Raising the bar in customer service

Proud to offer the largest selection of luxury oceanfront and oceanside vacation rentals on Hilton Head Island

4. Tax Advantages

Tax laws vary from state to state and depending on where you plan to invest in your vacation home, and how you plan to use it, there are several federal tax advantages that work in your favor. For example, much like your primary home, you can deduct interest on the mortgage of your second home. But did you know that because of the 2017 Tax Cuts and Jobs Act, the amount homeowners are able to deduct dropped from $1 million to $750,000 on qualified home loans? That number drops even lower if you have an existing mortgage on your primary home.

You can also deduct the interest you pay on the home equity debt of the vacation home. Our Realtors® and real estate agents at Multiple Listing Service of Hilton Head Island can get you in touch with a knowledgeable professional to advise you and your family of your specific tax advantages and costs of owning a vacation home.

5. Hire a knowledgeable, local real estate agent

Knowing where to hire the most knowledgeable professional begins with the right real estate agent on your team. Members of the top Multiple Listing Service in the area, such as HHIMLS, are highly trained professionals who have worked through a wide array of real estate transactions, including purchasing a vacation home. Equally as important, we’re members of the community. If it’s your vacation home, we know the trendiest new restaurants coming to town. If your vacation home will be a rental, we know how to get a hold of the councilman making decisions that will impact your property.

Connecting with the right Realtor® or real estate agent to purchase or invest in a vacation property can make the whole experience a breeze.